TradFi has taken another big step into Web3 with the launch of JP Morgan Chase’s tokenized carbon credit platform. The system uses blockchain tech to clear the murk from voluntary markets plagued by opacity and inconsistency.

Credits will be trackable from issuance to retirement, Morgan says, improving transparency, trust, and trading efficiency. Trials with firms like S&P Global Commodity Insights are already underway.

Moving carbon credits on-chain adds a new wrinkle to the real world asset (RWA) tokenization trend. Institutions from BlackRock to Deutsche Bank are looking at blockchain as a vehicle for streamlining settlement for instruments like stocks and treasury bills.

For Morgan, voluntary carbon markets present a unique opportunity. In an asset class where trust is low and friction is high, digitization could join-up fragmented systems and bed-in global standards.

Alastair Northway, head of natural resource advisory at JPMorgan Payments, said that tokenization is "Web3 disruptor for carbon credits, promising better price visibility, liquidity, and a globally compatible framework."

As the Wall Street giant expands further into Web3, it aims to explore whether blockchain can enhance trust and foster greater participation in carbon markets.

Cleaning Up Carbon Markets’ Reputation

Each carbon credit represents one metric tonne of COâ‚‚ that's been stopped from entering the atmosphere or removed from it by cleantech projects. Tradable permits give companies that reduce atmospheric carbon another option to monetize their work. Yet for all the good it aims for, the market has been subject to criticism.

Projects have frequently under-delivered on promised reductions, verification has been inconsistent, and double-counting all too common. Critics warn that credits do more to facilitate greenwashing than spur climate progress.

Blockchain, proponents say, offers a remedy. Tokens can hold immutable data records of credit's issuance, project details, and place in the lifecycle, making auditing easier and tampering harder. Lawyers at Calgary's Osler law firm write that tokenization could address "complex, inconsistent standards and unreliable data," though they stop short of calling it a complete fix.

From Certificate to Token

The process of tokenization is straightforward. A verified carbon credit is issued with metadata such as registration numbers, project details, and verification results encoded onto a digital token. The token lives on a blockchain. Smart contracts automate issuance and trading.

A four-stage process generates a token that can circulate on exchanges or specialized platforms, providing traceable ownership and potentially more liquidity:

- Issuance – A cleantech project like a solar plant or wind farm gets credit for eliminating a specific volume of COâ‚‚. A recognized national body, using standards like VCS, then issues a carbon credit certificate representing one metric ton of avoided emissions.

- Tokenization – The certificate is turned into a digital token on a blockchain. Metadata embedded in the software ensures registration numbers, project details, verification status, and emission metrics are available to regulators and counterparties.

- Trading – After tokenization is complete, the credits can be traded on crypto exchanges or bought & sold on dedicated platforms. Buyers and sellers gain full visibility into ownership and transfer history, while immutable ledgers reduce double-counting and fraud.

- Lifecycle Management – Once credits are used, they need to be removed from the market. Blockchain ensures retirements are recorded consistently, with an audit trail from creation to cancellation.

So far, Morgan has completed tests with EcoRegistry and the International Carbon Registry, while S&P Global continues its pilot project. The bank is also preparing to roll out JPMD, a stablecoin-style deposit token, on Coinbase's layer-2 Base network.

The Take Away

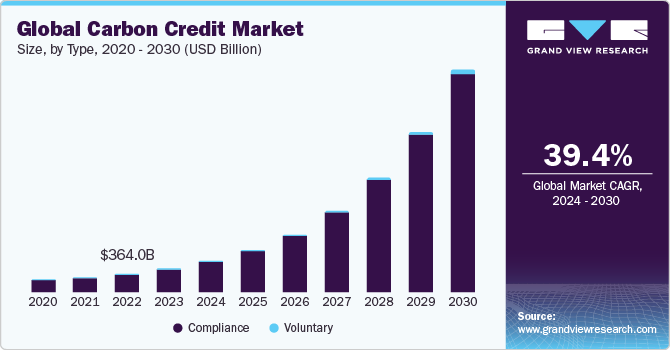

Tokenized carbon credits may be in a nascent phase but having a Wall Street stalwart's backing suggests a convergence is underway between DeFi and sustainable finance. The bank already backs major carbon projects and buys removal credits. Its analysts describe carbon markets as an emerging asset class that could flourish with improved infrastructure.

As one of Wall Street's earliest blockchain adopters, Morgan appears intent on making sure net zero and DeFi eventually meet. Such measures aim to make carbon markets behave more like traditional stock exchanges. Whether it can also make them just as credible remains to be seen.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.