The air crackles with an almost palpable energy. Every venture capitalist's inbox is overflowing with pitches, every tech conference features a sprawling AI pavilion, and the stock market, despite recent jitters, seems to be holding its breath, anticipating the next quantum leap. We are, undeniably, in the midst of an Artificial Intelligence boom.

Week after week we've seen massive investments in the AI space:

- Over $500 Million Pours Into AI Startups While Acquisition Activity Accelerates

- AI Funding Frenzy: Investors Pour Nearly $100M Into Generative Tool, Advertising, Finance Companies

- Over $120 Million Pours Into AI Startups Across New Frontiers

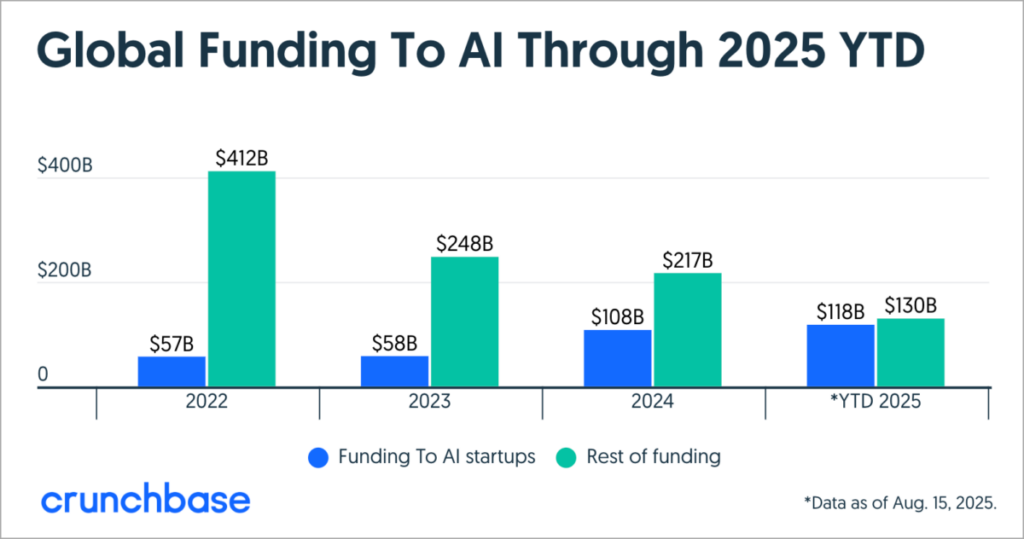

AI-related companies have raised $118 billion as of Aug. 15, up from $108 billion for all of 2024.

Source: Crunchbase

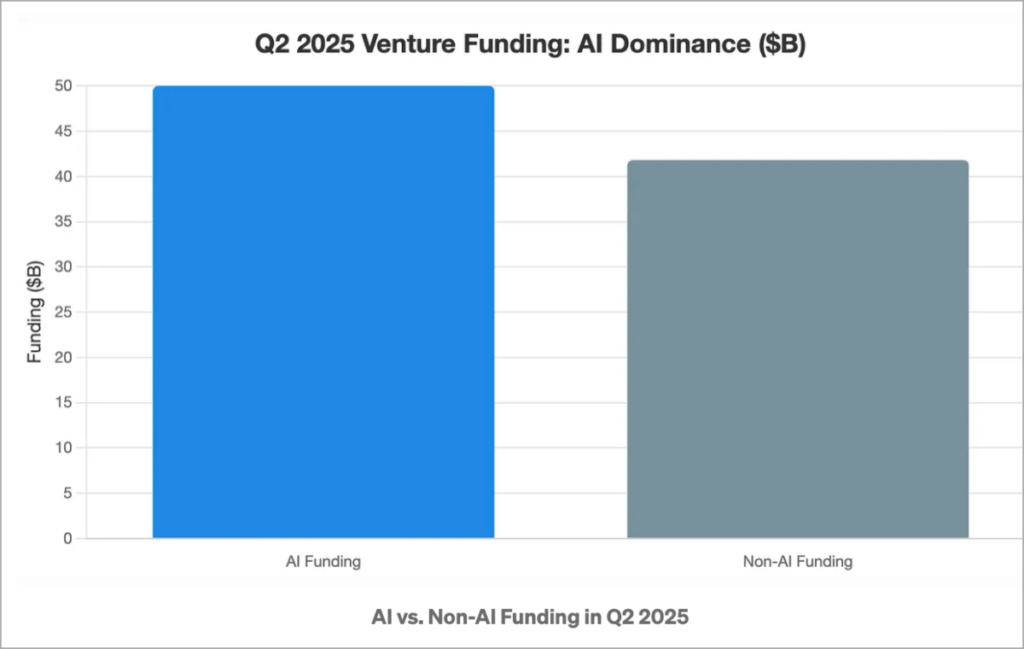

In Q2 2025 alone, AI startups raised over $50 billion of $101.5 billion total funding, while non-AI funding fell to a 7-year low.

Source: Olivier Khatib

As AI companies secure unprecedented funding and market valuations soar to stratospheric heights, the question emerges: Are we witnessing another speculative bubble destined to burst, or does the AI revolution represent a fundamentally different economic phenomenon?

Is history repeating itself, or is this time truly different? Are we hurtling towards another precipitous crash, or are we witnessing the dawn of a fundamental technological shift, one that will redefine industries and societies for generations to come? This extensive analysis will argue, unequivocally, that today’s AI boom is fundamentally different from history’s dot-com bust.

Revisiting the Dot-Com Bubble: Lessons and Legacy

To appreciate the distinctiveness of the AI boom, it is essential first to revisit the dot-com bubble's nature and consequences.

Between 1995 and 2000, internet-based companies experienced explosive growth in valuations, with the Nasdaq Composite index rising from under 1,000 to over 5,000 points. This period was riddled with massive speculation, as investors poured money into companies that often had little more than a “.com” suffix and a vague business plan.

Back then, only 48% of dot-com companies founded after 1996 were still operating in late 2004. And at least 4,854 internet companies were either acquired or shut down in the three years after early 2000.

Source: AI-Generated by Andre Bourque

The dot-com bubble was characterized by:

- Unbridled Speculation and Hype: Companies with little more than a catchy name and a ".com" domain received astronomical valuations based on projected, not actual, revenue. Business plans often lacked substance, focusing on user acquisition at any cost rather than sustainable profitability.

- Lack of Tangible Value and Profitability: Many internet companies, particularly in e-commerce and content, struggled to generate meaningful revenue. The prevailing wisdom was “get big fast,” with the hope that profitability would magically appear later. This often led to unsustainable burn rates.

- Immature Infrastructure: The internet infrastructure of the late 90s was still nascent. Dial-up connections were common, broadband was a luxury, and mobile internet was a distant dream. This limited the practical application and true scalability of many internet businesses.

- Easy Access to Capital: Venture Capital poured into anything internet-related, often with limited due diligence. This fueled the proliferation of “me-too” companies and a highly competitive, unsustainable market.

- The “Greater Fool” Theory: Many investors were buying into companies not because they believed in the underlying business model, but because they believed someone else would pay even more.

The bust was brutal. Companies vanished overnight, investor portfolios were decimated, and the word “dot-com” became synonymous with speculative folly.

The Roar of ‘Now’: Dissecting the AI Revolution

While the hype exists, and speculative elements are undeniable in any nascent market, the DNA of today’s AI boom is distinctly different than yesterdays dot com boom. Many factors play into this.

1. Technological Maturity and Infrastructure

Dot-Com Era: The internet in the late 1990s was still in its infancy. Broadband penetration was minimal, with most users connecting via dial-up modems. The infrastructure needed to support ambitious online businesses simply didn’t exist at scale.

AI Era: Today’s AI boom is built upon decades of research and development, powerful cloud computing infrastructure, and massive datasets. Companies like NVIDIA have spent years developing the specialized hardware that enables modern AI applications, while cloud providers have built the distributed computing systems necessary for training large models.

Unlike the speculative internet companies of the late ’90s, today’s leading AI firms are developing technologies on the back of established digital infrastructure and proven computational methods

2. Revenue Models and Commercialization

Dot-Com Era: Many dot-com companies operated on the principle of “growth at all costs,” prioritizing user acquisition over sustainable revenue models. The infamous “eyeballs over earnings” approach led to companies with massive valuations but no clear path to profitability.

AI Era: While some AI startups are pre-revenue, many leading AI companies have already demonstrated clear commercial applications and revenue streams. OpenAI’s ChatGPT achieved one million users within five days of launch and quickly established subscription models. Enterprise AI solutions from companies like Palantir and Databricks are already generating substantial revenue from Fortune 500 clients.

Today’s AI companies are demonstrating monetization potential much earlier in their lifecycles, with enterprise adoption driving revenue growth even for emerging players.

3. Corporate Integration and Adoption

Dot-Com Era: Traditional businesses were slow to adopt internet technologies, often treating their online presence as an experimental side project rather than a core business function.

AI Era: Major corporations across all sectors are rapidly integrating AI into their core operations. From healthcare giants using AI for drug discovery to financial institutions implementing AI for risk assessment, the technology is being woven into existing business processes rather than existing in parallel.

The speed of enterprise AI adoption represents a fundamental difference from the dot-com era. Companies aren’t just experimenting with AI, they’re restructuring their operations around it.

4. Market Participants and Investment Patterns

Source: AI-Generated by Andre Bourque

Dot-Com Era: The dot-com bubble was characterized by retail investor frenzy, with day traders and individual investors driving much of the market speculation. Initial public offerings (IPOs) were rushed to market to capitalize on investor enthusiasm.

AI Era: While there is certainly retail interest in AI stocks, much of the investment in AI comes from sophisticated venture capital firms, private equity, and corporate strategic investments. Many leading AI companies have remained private longer, building substantial technology and business foundations before considering public markets.

The Economic Impact: Transformation vs. Disruption

Productivity and Economic Growth

The dot-com bubble, for all its excesses, did lay groundwork for genuine economic transformation. However, the productivity gains from internet adoption took years to materialize in economic data.

AI’s impact on productivity has already proven to be more immediate and measurable. AI could boost global economic output by up to 15% over the next decade. This productivity enhancement comes from AI’s ability to automate complex cognitive tasks, optimize processes, and augment human capabilities across virtually all industries, including:

- Enhanced productivity: Automating routine tasks can allow workers to focus on more complex, high-value activities, increasing overall efficiency and output.

- Accelerated innovation: AI can speed up product development and help create new services and business models.

- Increased capital investment: The massive investments being poured into AI infrastructure--such as data centers and specialized hardware--add directly to GDP.

- “Leveling up” workers: AI tools can be particularly effective at boosting the productivity of less experienced workers, helping to improve skill levels across the labor force.

Labor Market Transformation

The internet ultimately created more jobs than it displaced, but this transition took time and caused significant disruption. AI’s impact on labor markets may be more complex and potentially more disruptive in the short term. While AI will create new job categories and enhance many existing roles, it could also accelerate the automation of approximately 30% of work activities across the economy by 2030. This suggests a more significant and potentially faster transformation of labor markets than occurred during the internet revolution.

Market Valuation: Froth vs. Fundamentals

Valuation Metrics and Investor Expectations

The dot-com bubble was characterized by astronomical price-to-earnings ratios and companies valued at billions despite minimal revenue. While some AI companies command high valuations relative to current revenue, there are important distinctions.

- Revenue Growth Trajectories: Leading AI companies are demonstrating steeper revenue growth curves than many dot-com counterparts.

- Established Tech Integration: Major technology companies like Microsoft, Google, and Amazon are integrating AI into existing profitable business lines rather than creating standalone speculative ventures.

- Enterprise Adoption Velocity: The speed at which businesses are implementing AI solutions suggests faster paths to monetization than many internet technologies experienced.

While certain segments of the AI market show frothy valuations, the underlying business fundamentals are generally stronger than what we saw during the dot-com era. Companies are being valued not just on potential but on demonstrated capabilities and adoption metrics.

Regulatory Environment and Governance

The dot-com era operated in a relatively unregulated environment, with few guardrails on business practices or investor protections specific to internet companies. The AI landscape is evolving within a much more mature regulatory framework, with increasing attention to:

- Ethical AI Development: Standards and guidelines for responsible AI are being developed alongside the technology rather than as an afterthought.

- Investment Disclosure Requirements: More stringent requirements for companies to disclose technological capabilities and limitations.

- International Coordination: Emerging global frameworks for AI governance that may prevent the most extreme market excesses.

The regulatory environment surrounding AI represents a stabilizing force that was largely absent during the dot-com boom. This oversight may help prevent the most speculative excesses while still allowing for innovation.

Lessons Applied: Learning from History

Source: AI-Generated by Andre Bourque

Perhaps the most significant difference between today’s AI boom and the dot-com bubble is that investors, entrepreneurs, and policymakers are consciously applying lessons learned from that earlier period:

- Sustainable Growth Focus: More emphasis on building sustainable business models before scaling.

- Technical Due Diligence: Investors are conducting more rigorous technical assessments of AI capabilities.

- Measured Public Market Approach: Companies are remaining private longer to establish business fundamentals.

- Diversified Revenue Strategies: AI companies are pursuing multiple commercialization paths rather than betting on single business models.

The collective memory of the dot-com crash has created a more disciplined approach to building and investing in AI companies. This historical perspective may help the industry avoid repeating the most damaging patterns of the past.

Risks and Vulnerabilities

Despite these differences, the AI boom is not without significant risks:

Technical Limitations and Hype Cycles

AI technologies, particularly generative AI, face challenges including hallucinations (generating false information), high computational costs, and limitations in reasoning capabilities. The gap between public perception of AI capabilities and actual technological limitations could lead to a “trough of disillusionment” if progress stalls.

Concentration of Power and Resources

The enormous computational resources required for cutting-edge AI development have concentrated power in the hands of a few large technology companies and well-funded startups. This concentration could limit innovation and create winner-take-all dynamics that ultimately harm the broader ecosystem.

Geopolitical and Security Concerns

Unlike the relatively open development of internet technologies, AI advancement is increasingly viewed through a national security lens, with countries implementing export controls and investment restrictions. These geopolitical tensions could fragment the AI market and limit its economic potential.

Evolution, Not Repetition

While surface-level comparisons between the AI boom and dot-com bubble are tempting, the fundamental differences in technological maturity, business models, adoption patterns, and market dynamics suggest we are witnessing a distinct economic phenomenon rather than a simple historical repetition.

The AI revolution represents a more deeply transformative technological shift, built upon established digital infrastructure and addressing more fundamental aspects of human cognitive work. Its integration into existing business processes and industries provides stronger foundations for sustainable growth than many dot-com ventures achieved.

This doesn’t mean the AI sector is immune to market corrections or that all AI companies will succeed--indeed, a shakeout of less viable players is virtually inevitable. However, the underlying technological and economic foundations of the AI boom appear substantially stronger than those that supported the dot-com bubble.

Investor Outlook

Source: AI-Generated by Andre Bourque

For investors, caution remains paramount. Due diligence, a focus on fundamentals, and a long-term perspective are crucial. However, dismissing the entire AI phenomenon as “another dot-com bubble” would be a profound miscalculation, akin to dismissing the early internet or personal computing as mere fads.

The current wave of AI is not just about making existing tasks more efficient; it’s about enabling entirely new capabilities, fostering novel industries, and fundamentally altering how we interact with technology and the world around us. From accelerating scientific discovery to revolutionizing creativity and automating complex decision-making, AI is poised to be the defining technological force of the 21st century.

We are not just witnessing a boom; we are participating in a profound technological evolution. The future, powered by artificial intelligence, is not just arriving; it is being built, piece by intelligent piece, right before our eyes. And unlike the dot-com bust, this time, the foundations are far more solid, and the implications, far more profound.

Feature Image AI-Generated by Andre Bourque

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.